As the new year approaches, investors are looking for ways to diversify their portfolios and generate steady income. One popular option is investing in Real Estate Investment Trusts (REITs). REITs allow individuals to invest in real estate without directly managing properties, providing a lucrative opportunity for those seeking to capitalize on the property market. In this article, we will explore the top 10 REITs to buy for 2025, according to industry experts and market trends.

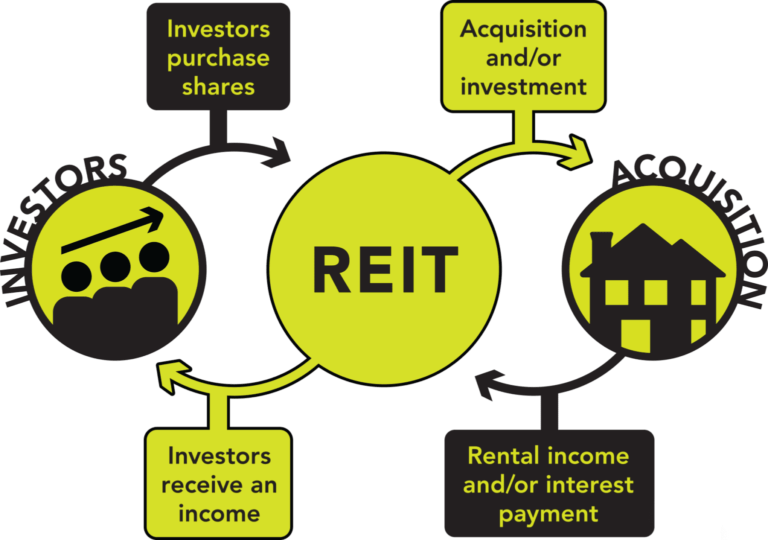

What are REITs?

REITs are companies that own or finance real estate properties and provide a way for individuals to invest in real estate without directly managing properties. They can be classified into several categories, including equity REITs, mortgage REITs, and hybrid REITs. Equity REITs invest in and own properties, while mortgage REITs invest in and own property mortgages. Hybrid REITs combine elements of both equity and mortgage REITs.

Benefits of Investing in REITs

Investing in REITs offers several benefits, including:

Diversification: REITs provide a way to diversify your portfolio by adding a real estate component, which can help reduce risk and increase potential returns.

Income Generation: REITs are required to distribute at least 90% of their taxable income to shareholders, providing a steady stream of income.

Liquidity: REITs are traded on major stock exchanges, making it easy to buy and sell shares.

Professional Management: REITs are managed by experienced professionals, allowing investors to benefit from their expertise without directly managing properties.

Top 10 REITs to Buy for 2025

Here are the top 10 REITs to buy for 2025, based on their financial performance, growth prospects, and industry trends:

1.

Realty Income (O): A retail REIT with a strong track record of dividend payments and a diverse portfolio of properties.

2.

National Retail Properties (NNN): A retail REIT with a focus on single-tenant properties and a history of consistent dividend payments.

3.

Simon Property Group (SPG): A retail REIT with a large portfolio of high-end properties and a strong track record of financial performance.

4.

Welltower (WELL): A healthcare REIT with a focus on senior housing and outpatient medical properties.

5.

Ventas (VTR): A healthcare REIT with a diverse portfolio of senior housing, medical offices, and hospitals.

6.

Equity Residential (EQR): A residential REIT with a focus on apartment properties in urban areas.

7.

AvalonBay Communities (AVB): A residential REIT with a focus on luxury apartment properties in high-growth markets.

8.

Prologis (PLD): An industrial REIT with a global portfolio of logistics and distribution properties.

9.

Duke Realty (DRE): An industrial REIT with a focus on logistics and distribution properties in key markets.

10.

Crown Castle International (CCI): A communications REIT with a focus on cell towers and other wireless infrastructure.

Investing in REITs can provide a lucrative opportunity for those seeking to diversify their portfolios and generate steady income. The top 10 REITs listed above offer a range of benefits, including strong financial performance, growth prospects, and a history of consistent dividend payments. As with any investment, it's essential to do your research and consult with a financial advisor before making any decisions. With the right strategy and a bit of patience, investing in REITs can help you achieve your financial goals in 2025 and beyond.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.

:max_bytes(150000):strip_icc()/GettyImages-960287192-28108b63c00941988a6890e321c2c1e2.jpg)